Committed to Creating a Better Financial Environment

Cashbus believes that mobile finance is the future mainstream form of finance, and inclusive finance is our goal. Driven by big data, financial service can be accessible to the millions of population whom cannot be covered by traditional financial services. Empowered by artificial intelligence, Cashbus has invented a fully automated process. Thousands of decisions are made every second by our fast credit evaluation system. With millions of successful cases, our risk control engine has been tested and recognized as the world-leading class.

Core Technique

Big Data Analytics

Build credit risk profile with thousands of dimensions by aggregating data both internal and external.

Big Data Analytics

Build credit risk profile with thousands of dimensions by aggregating data both internal and external.

Credit Decision Engine

Process massive real-time data to drive accurate credit decision-making under subsecond.

Credit Decision Engine

Process massive real-time data to drive accurate credit decision-making under subsecond.

Risk Management

Establish a comprehensive and effective risk control system with strategy deeply running through the entire user lifecycle.

Risk Management

Establish a comprehensive and effective risk control system with strategy deeply running through the entire user lifecycle.

Artificial Intelligence

Dedicate to exploring cutting-edge artificial intelligence development, and applying them to improve the automation of business conduction.

Artificial Intelligence

Dedicate to exploring cutting-edge artificial intelligence development, and applying them to improve the automation of business conduction.

Big Data Analytics

Build credit risk profile with thousands of dimensions by aggregating data both internal and external.

Big Data Analytics

Build credit risk profile with thousands of dimensions by aggregating data both internal and external.

Credit Decision Engine

Process massive real-time data to drive accurate credit decision-making under subsecond.

Credit Decision Engine

Process massive real-time data to drive accurate credit decision-making under subsecond.

Risk Management

Establish a comprehensive and effective risk control system with strategy deeply running through the entire user lifecycle.

Risk Management

Establish a comprehensive and effective risk control system with strategy deeply running through the entire user lifecycle.

Artificial Intelligence

Dedicate to exploring cutting-edge artificial intelligence development, and applying them to improve the automation of business conduction.

Artificial Intelligence

Dedicate to exploring cutting-edge artificial intelligence development, and applying them to improve the automation of business conduction.

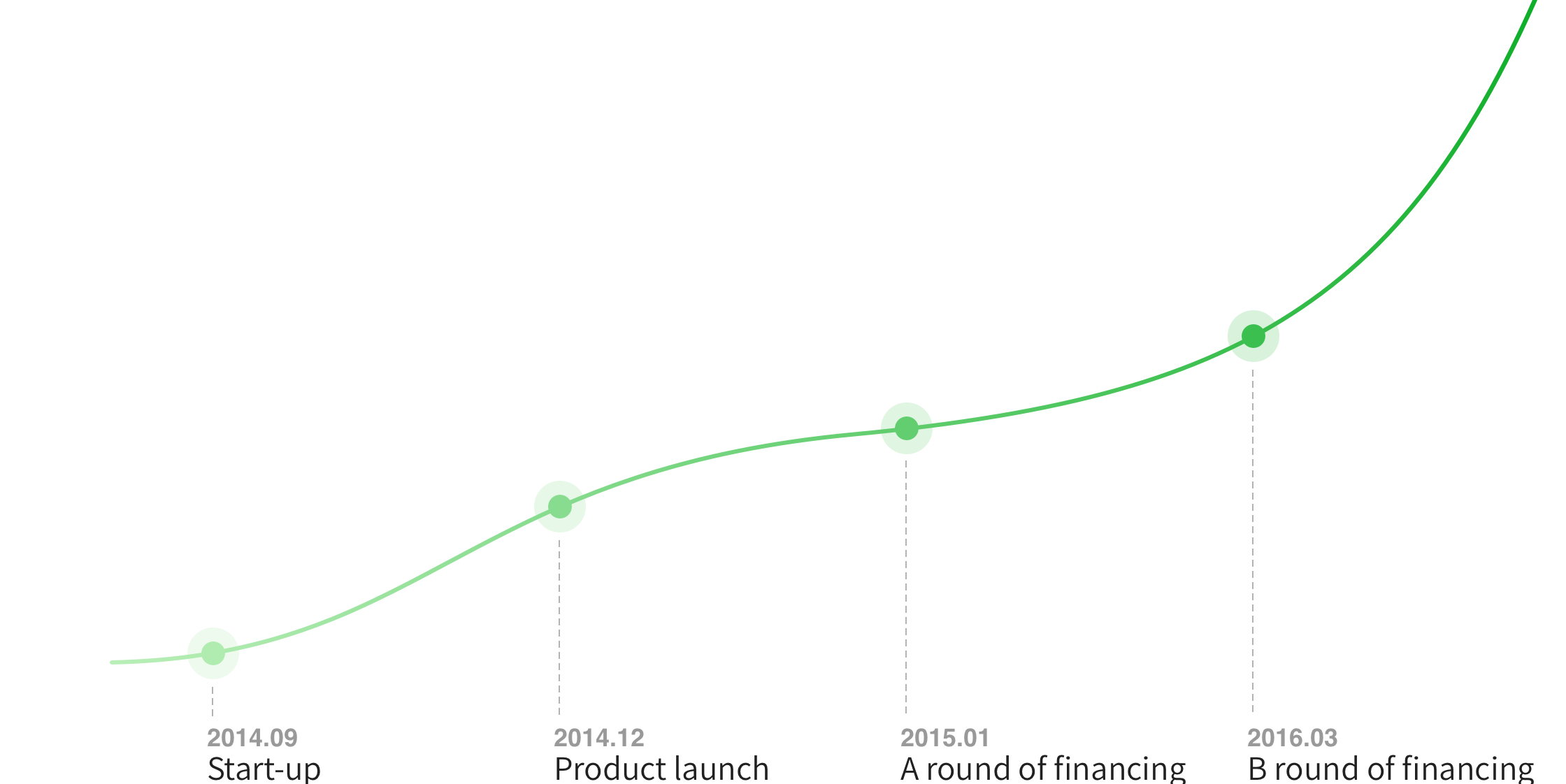

Development History

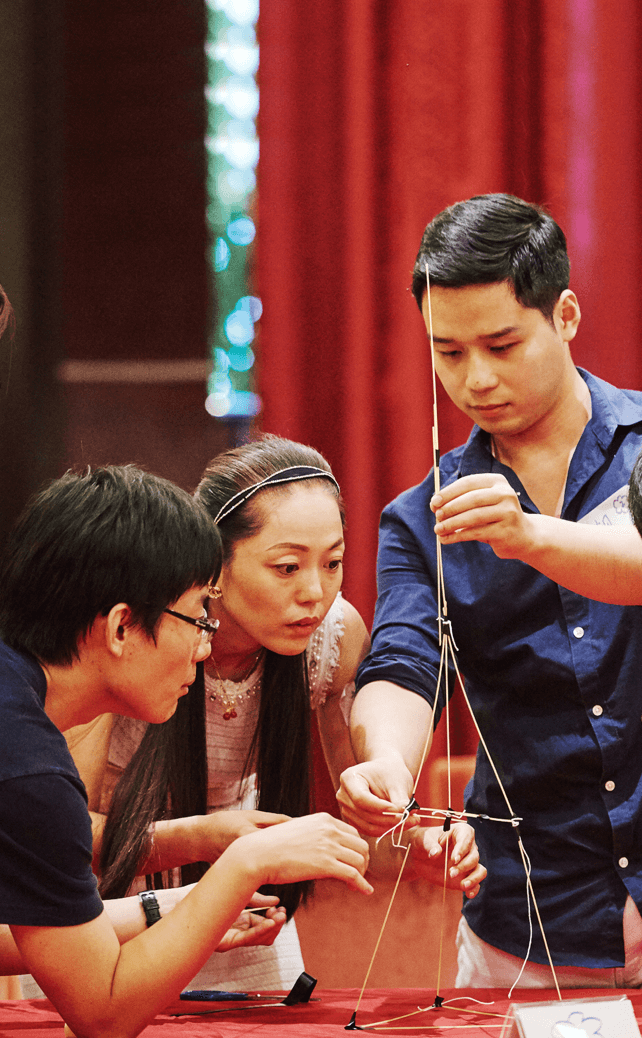

Team

Solidarity / Collaboration

Solidarity / Collaboration

Diligence

Diligence

Share The Joy

Share The Joy

Investor

Our Users

Our Team

Our passionate team of serial entrepreneurs and IT experts have more than 10 years’ experience from some of the top FinTech companies in the world, with experts in risk control, internet, mobile internet technology and customer service.

Honesty Passion

Honesty Passion Professionalism

Collaboration, Embracing Changes

Collaboration, Embracing Changes

Effecienct & Delightful

Effecienct & Delightful

User First

User First

Spirit of The Geek

Spirit of The Geek

International Vision

International Vision

Customer Service; Complaint Handling; Brand Cooperation; Marketing Cooperation; Media Coopertation; Advertising Cooperation

If there is any question about us, please contact our customer service staff.

Service Email: service@cashbus.com

Join Us

If you want to join the us, please send your resume to hr@cashbus.com. We will contact you as soon as possible.

hr:hr@cashbus.com

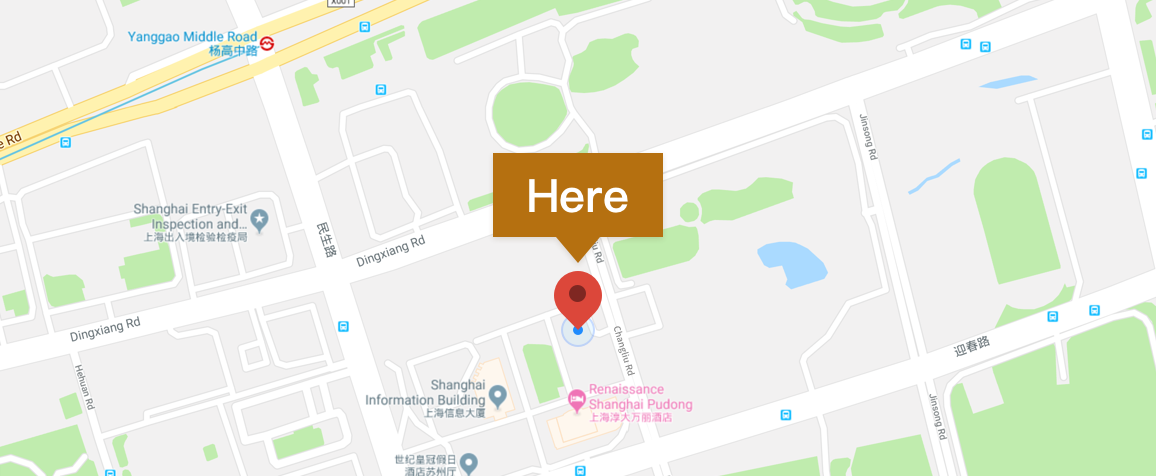

Address

No. 58 Changliu Rd, Pudong District, Shanghai

Hotline: +86-021-10101058 (Monday to Sunday 9:30~18:20)